01. Get customized portfolio according to the scheme you choose

02. We earn only when you earn, pay only for performance, transparent fee structure

03. Get dedicated relationship manager for your wealth management

04. Book an expert call and get started

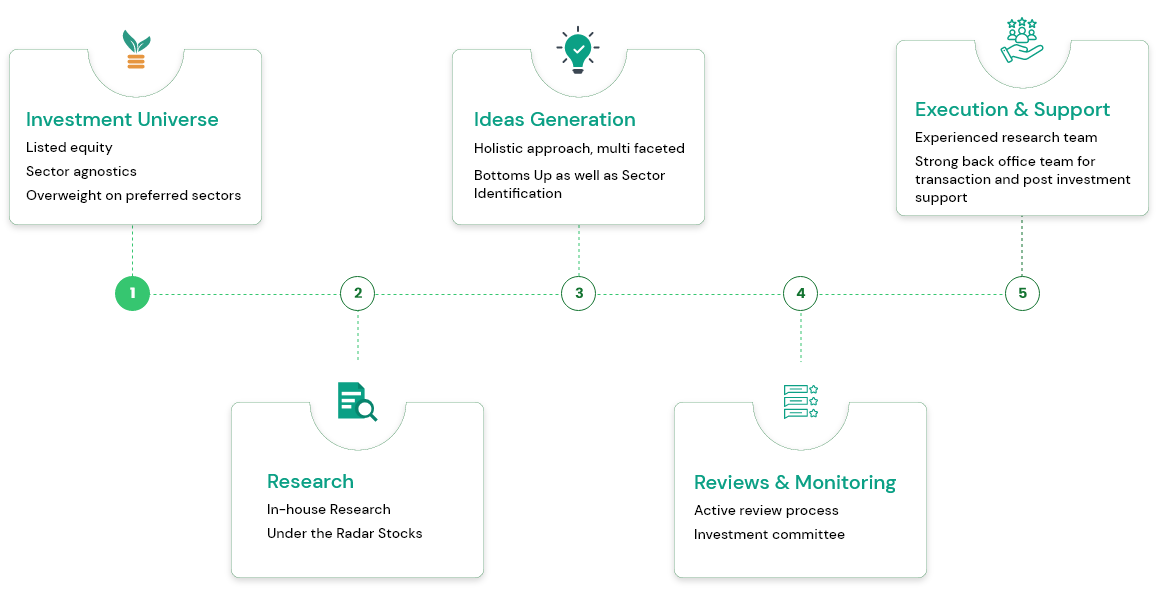

Portfolio Management Services

Portfolio Management Services